Written by Giulia Prati, Vice President of Research at Opinium – in collaboration with Clark Nesselrodt, SVP, Account Director at Brilliant PR & Marketing

The biggest concern for US adults relating to COVID-19 is its impact on the economy, topping worries about themselves or loved ones becoming ill. At the most granular level, this has to do with daily cuts in spending multiplied across millions of Americans whose spending power has suddenly been crippled. Still, our new homebound existence is causing increased spending in a select few (extremely lucky) industries.

To begin to unpack how consumer-facing industries will be affected, insights firm Opinium asked 2,006 US adults between March 20th and 25th how they anticipate the pandemic will impact their usual purchasing behavior.

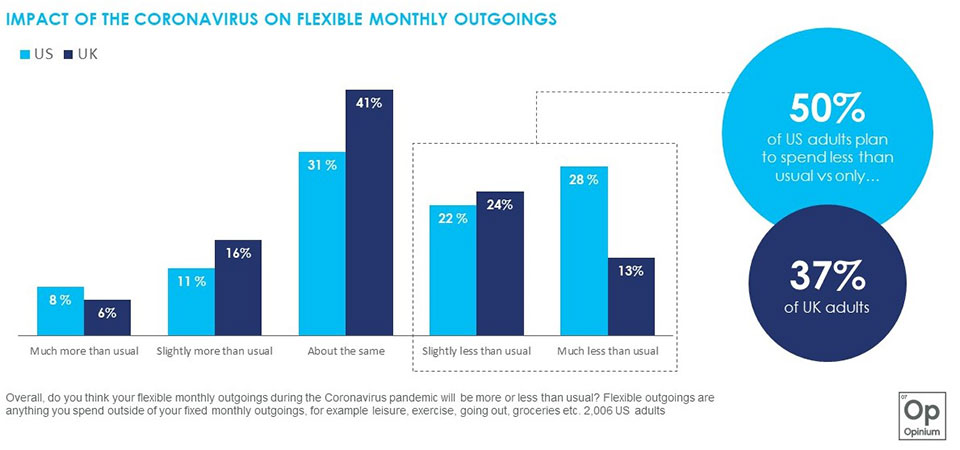

Half of US adults anticipate their flexible monthly outgoings will drop.

This is a staggering figure when compared with the UK, where only 37% say they will spend less. Twenty-eight percent of US adults say they will spend much less compared to only 13% in the UK. This does not bode well for the US economy.

The minority who expect to spend more during COVID-19 expect this to be largely due to grocery shopping—both because they are stashing up on essentials and due to the perception of prices rising.

Which industries will be the hardest hit?

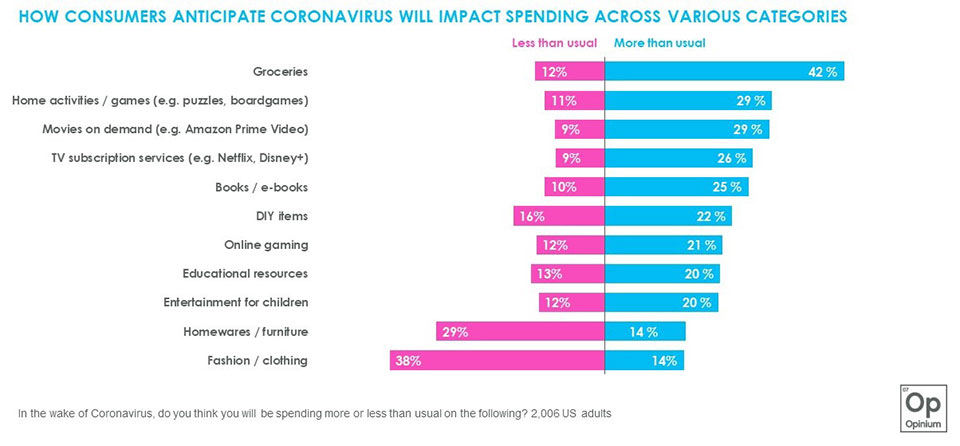

Though of course the restaurant, travel, and hotel industries will see sharp declines as a result of stay-at-home orders, consumers also anticipate cutting spending on fashion and furniture.

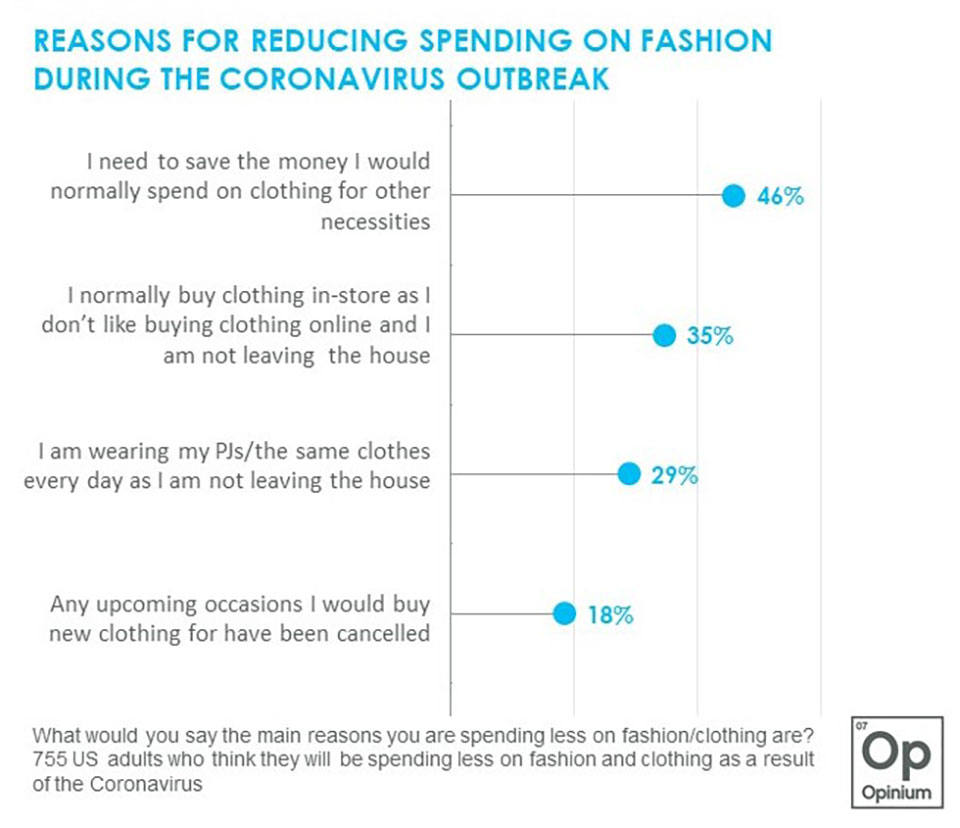

Fashion & Clothing

The fashion and clothing industry stands to experience the biggest drops in sales across the industries surveyed, with nearly 2 in 5 (38%) saying they plan to spend less on the category in the wake of the crisis. However, shopping intent in the category varies greatly by age group—Older respondents are much more likely to cut spending on fashion, driven by their preference for buying clothing in-store. Meanwhile, a quarter of 18-34s (25%) plan to increase their fashion spending during the crisis, with more time at home to indulge in online shopping, compared to only 3% of 55-64s.

Homewares & Furniture

The homewares and furniture category will also likely see significant drops in sales—29% of US adults anticipate spending less on the category during COVID-19. Again, older age groups are more likely to cut spending likely due to their discomfort shopping online.

What is a brand to do?

Make the digital shopping experience as intuitive to navigate as possible to avoid any additional hemorrhaging and to reduce friction for any older shoppers who may try online shopping while stores are shut down.

Where will consumers spend more?

Though the largest share of US adults plan to reduce their flexible monthly outgoings, 19% anticipate their spending will increase. Which industries stand to benefit most?

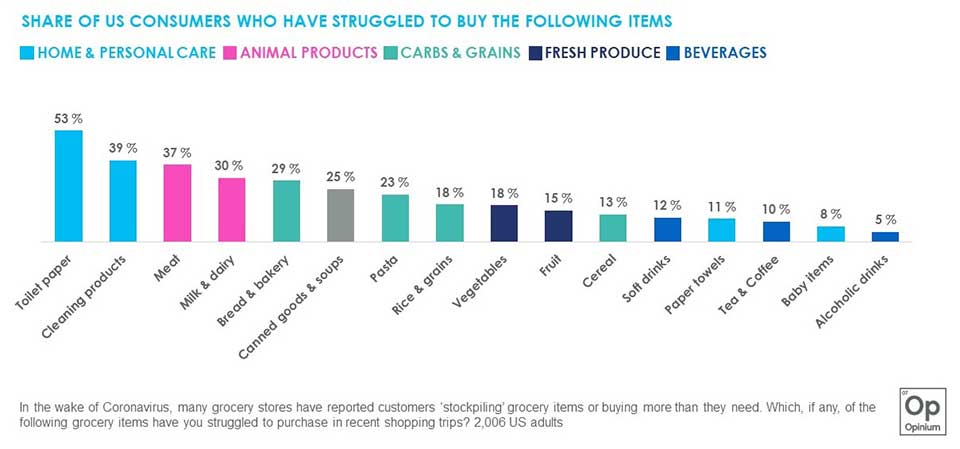

Groceries (of course)

No surprise here—With stockpiling instincts kicking in, demand for ‘essential’ grocery and household items has skyrocketed. Over half of US adults (53%) report struggling to purchase toilet paper in recent trips to the store and 39% have encountered shortages of cleaning products. The next most in-demand categories (judging by the share of respondents who have struggled to buy them) appear to be meat, milk and dairy, bread and bakery items, canned goods and soups, and pasta. In terms of food products, consumers appear to be prioritizing meat and dairy over fruits and vegetables, revealing an inclination towards higher-calorie comfort foods.

Over half of Americans (54%) agree that Walmart has been the supermarket worst-hit by panic buying. Though Walmart is not alone in these initiatives, its senior shopping hours for those over 60 and its promise to keep prices fair despite increased demand have received praise. The retailer has also temporarily closed non-essential parts of the store (e.g., auto care and jewelry counters) so associates may focus on stocking and cleaning higher-priority sections. Despite such initiatives, a large chunk (39%) of Americans don’t think any supermarket has implemented effective practices to avoid future panic buying.

At-home Entertainment

Movies on demand, TV subscription services, online gaming, and good old-fashioned books naturally stand to benefit from Americans spending more time entertaining themselves at home rather than out on the town.

Family & Children’s Products

With schools and extra-curricular programs shutting down, parents are suddenly on duty to educate and entertain their kids 24/7. It is no wonder, then, that we see 29% of US adults anticipating spending more on home activities and games (e.g., puzzles, board games) and 20% anticipating spending more on educational resources and entertainment for children.

Adults aged 18-34 and 35-44 (those most likely to have young children in the home) are significantly more likely than the rest of the population to increase spending on entertainment for children—42% and 43% of adults in those age groups who usually spend money on kids’ entertainment plan to ramp up spending during COVID-19.

Great content! Super high-quality! Keep it up!

Very good article, thank you for sharing

Great info. I just love this. Thank you!

Your sharing is very helpful

Hey!! Love the post.

limited consumers go out and buy more online.

tank you I will save your blog in future reference

Articles related to interesting and interesting music topics